Do you need any clarification on your allowances before you start shopping at duty-free at Luton Airport? Still a bit confused about the new Brexit rules and what they mean for your purchases? Worry not—we’ve got you covered! Whether you’re travelling to the EU or further afield, it’s important to know what you can and can’t bring with you. From tobacco and alcohol limits to gifts and souvenirs, we’ll help you shop smart and stay within the rules.

Read on below for a clear breakdown of your duty-free entitlements and allowances, so you can shop with confidence and make the most of your time at the airport.

As Brexit has taken place, this means that there are now new rules to duty-free allowances! But worry not, you are still allowed to bring a fair amount of goods and services into the UK without being charged extra tax! We will go over all the new rules and try to make it as simple as we possibly can for you.

When you are bringing the goods to the UK, you must be bringing them in yourself. They can be for your personal use or you could give them away as a gift. You must not go over your allowance and if you do, you have to declare them before arriving in the UK, to whichever category they fit. We will talk about the different categories and the allowances you have below.

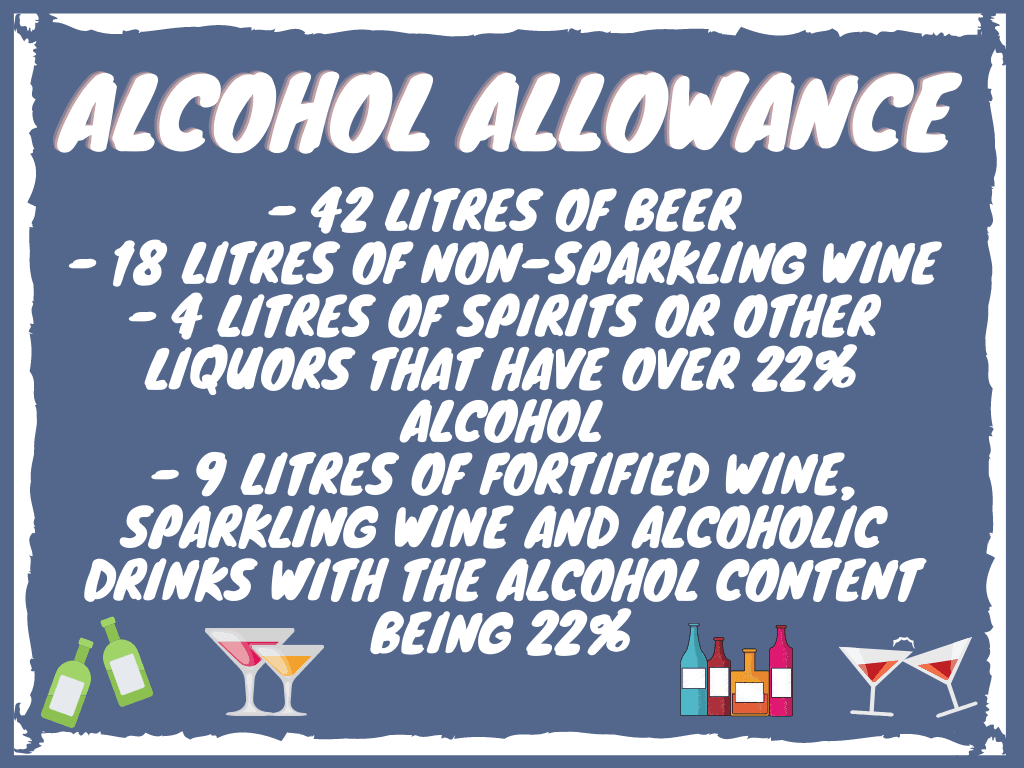

You are allowed to bring a generous amount of alcohol! You may bring in:

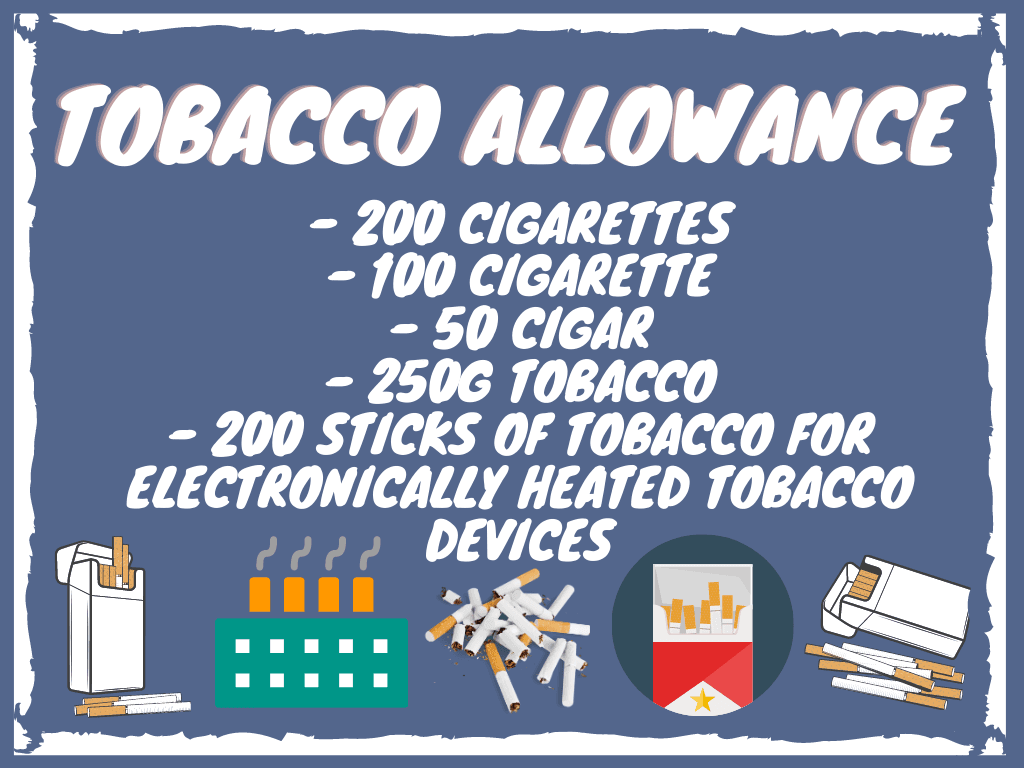

You're allowed a generous tobacco allowance too, including:

If you're under the age of 17, then, unfortunately, you are not allowed any personal allowance. However, if you still wish to bring it, you will have to pay tax and duty on them before your arrival in the UK.

If you want to bring other goods, you can bring up to £390. If you want to bring more, you will have to pay duty and tax on the total sum, not just the sum that's gone above the allowance. Make sure that you don't go over because you may have to pay import VAT too as well as duty and tax. We're sure you don't want to do that so ensure your total sum doesn't go over the limit!

You can choose to do your duty-free shopping from the comfort of your own home with Luton; simply select the items you wish to purchase, and once you're at the airport, pick them up and that's it. Don't forget to check out our shopping page for more information!